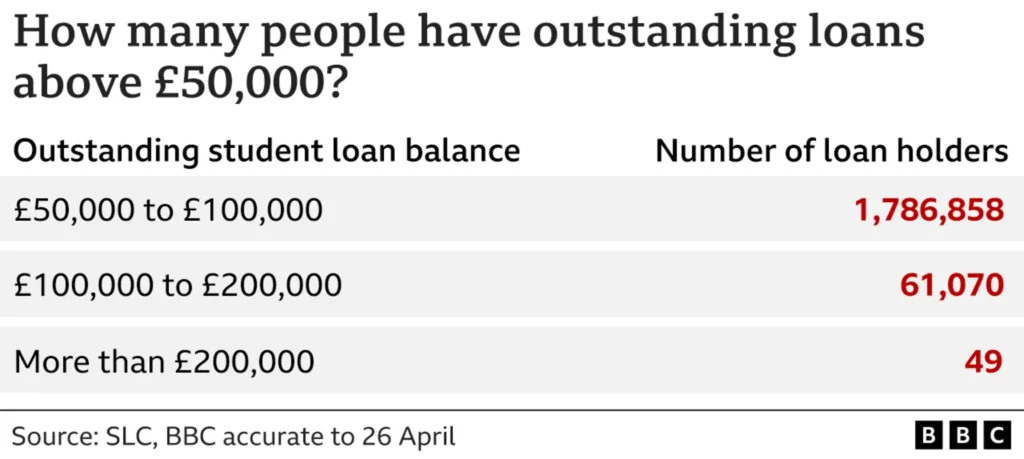

When we think of student debt, it is only natural to associate it primarily with the US. However, recent data shows that nearly 1.8 million people in the UK owe over £50,000 in student debt.

✅ AI Essay Writer ✅ AI Detector ✅ Plagchecker ✅ Paraphraser

✅ Summarizer ✅ Citation Generator

Key Takeaways:

- Over 61,000 people have student loan balances exceeding £100,000.

- The highest individual student debt now stands at £252,000.

- High-interest rates and lengthy courses contribute to rising debt levels.

Alarm! The Rise of Student Debt in Britain

Recent figures from the Student Loans Company (SLC) show a significant increase in student debt, with almost 1.8 million individuals owing at least £50,000. Notably, over 61,000 borrowers have debts surpassing £100,000, and 50 individuals owe upwards of £200,000. The average balance for those starting repayments has risen to £48,470.

According to Tom Allingham from Save The Student, these figures are “alarming” but not representative of the average student’s experience. Personal finance expert Martin Lewis describes the debt as a “limited form of graduate tax,” emphasizing that repayments are based on earnings rather than the total owed.

Interest rates, currently near 8% due to high inflation, and the length of study courses significantly impact debt levels. Titi, a senior electrical engineer, sees his student debt of over £128,200 continuously rise despite regular payments. He believes the system discourages some from pursuing higher education.

Calls for Reform – How Politicians Reacted

The National Union of Students (NUS) criticizes the lack of proposed reforms to student finance in the current election campaign. They argue that the current system disproportionately affects students from working-class backgrounds, leading to higher debts and slower repayment rates.

Claire Callender, a higher education policy professor, warns that such high debt levels can negatively impact graduates’ lives. The data also suggests that the student loan system fails to function effectively at extreme debt levels, with fewer than 50 people collectively owing at least £10 million.

Nick Hillman, director of the Higher Education Policy Institute, finds the number of individuals with debts over £200,000 particularly shocking, indicating a system that doesn’t work well for those borrowers.

The political response to the growing student debt crisis varies. The Conservatives highlight their actions to freeze tuition fees and cap real-term repayments, while Labour acknowledges the current system’s flaws and promises reforms. The Liberal Democrats advocate for the reinstatement of maintenance grants, and the Green Party proposes abolishing tuition fees altogether.

Despite the differing approaches, the Department for Education has not commented on the issue due to pre-election restrictions. As debates continue, heavily indebted graduates and current students await changes to the system.

Follow us on Reddit for more insights and updates.

Comments (0)

Welcome to A*Help comments!

We’re all about debate and discussion at A*Help.

We value the diverse opinions of users, so you may find points of view that you don’t agree with. And that’s cool. However, there are certain things we’re not OK with: attempts to manipulate our data in any way, for example, or the posting of discriminative, offensive, hateful, or disparaging material.