In today’s fast-paced job market, salary often becomes the centerpiece of career decisions. But when offered two distinct pay scales, how does one choose? A recent discussion on Reddit explored this dilemma, gathering a range of perspectives from experienced professionals and newcomers. Read on as we analyze the most persuasive arguments from this engaging debate.

✅ AI Essay Writer ✅ AI Detector ✅ Plagchecker ✅ Paraphraser

✅ Summarizer ✅ Citation Generator

Key takeaways:

- An initial salary can set a precedent for future earnings, influencing one’s overall career trajectory and financial growth over the years.

- The real value of a salary is deeply intertwined with the cost of living in a specific region.

- A comfortable and secure lifestyle is more about astute financial management and wise lifestyle choices than just the size of a paycheck.

As the graduation cap and gown are neatly tucked away, many recent graduates find themselves standing at a crossroads, sifting through multiple job offers. While a hefty salary might glitter magnetically, it’s not always the golden ticket to job satisfaction. Beyond the dollar signs, there’s a host of other considerations – from work-life balance and company culture to growth opportunities and location. For the uninitiated, this can be an overwhelming decision, one that requires a holistic evaluation rather than a mere glance at the paycheck. Recognizing this common concern, one such individual took to Reddit, voicing their uncertainties and seeking guidance from the community on their next career move:

“I’m going to graduate this semester and I received a job offer out of state in CT, USA for about $80K. Going out of state, I have to worry about bills such as rent, food, car payments, college loans, etc. This is the only offer that I’ve received so far and I’m waiting on multiple offers from various companies in my state (NJ), but they’re taking quite awhile to get back to me and those jobs pay around $40K – $55K roughly. ”

The Long-Term Salary Impact

A starting salary, while immediately impactful on one’s immediate lifestyle and purchasing power, carries long-term implications that ripple throughout a person’s career. Often those who secure a higher starting salary typically experience a “compounding advantage” over their peers. This means that a small salary advantage early on can translate into a significantly larger income disparity throughout a career.

There are several reasons for this cascading effect:

Annual Raises: Most companies offer raises as a percentage of the current salary. Even a modest 3% annual raise on an $80,000 salary results in a bigger absolute increase compared to the same percentage on a $40,000 salary.

Job Changes: When moving to a new job or position, the offered salary is often based on one’s current earnings. Starting higher can thus set a precedent, leading to progressively higher salaries with each job change.

Perceived Value: There’s a psychological aspect at play. A higher salary can often be perceived by both the individual and potential employers as a testament to one’s skills and value, making it easier to command higher salaries in future negotiations.

Several Reddit users emphasized the gravity of this long-term impact. One of them noted,

“If you take the 40k, it might take you another 10 years before you are making 80k.”

Another elaborated on the snowballing effect, stating,

“All of your future raises and people looking to hire you for the next job will be pegging you off of a higher place and higher trajectory.”

Yet another user highlighted the pitfalls of starting low:

“Future employers will consider your existing salary when making offers to you, impacting your earnings for years to come.”

In essence, the decision to a starting salary isn’t just about immediate financial comfort—it’s an investment in one’s financial trajectory for decades to come.

Living Expenses and Geographic Differences

The location of a job plays a crucial role in determining the real value of a salary. Two salaries might be numerically equivalent but can have vastly different purchasing powers depending on the geographic region. Factors such as housing, utilities, transportation, healthcare, and even leisure activities vary significantly from one state to another.

For instance, living in a bustling city center with a high demand for housing, like San Francisco or New York City, will inherently come with higher rental costs compared to smaller towns or cities in the Midwest. Similarly, states with a higher population density or limited resources might have increased costs for basic necessities, including food and utilities. Additionally, some states have higher income taxes, which can further eat into a salary, while others might have beneficial tax breaks that can make a noticeable difference to one’s take-home pay.

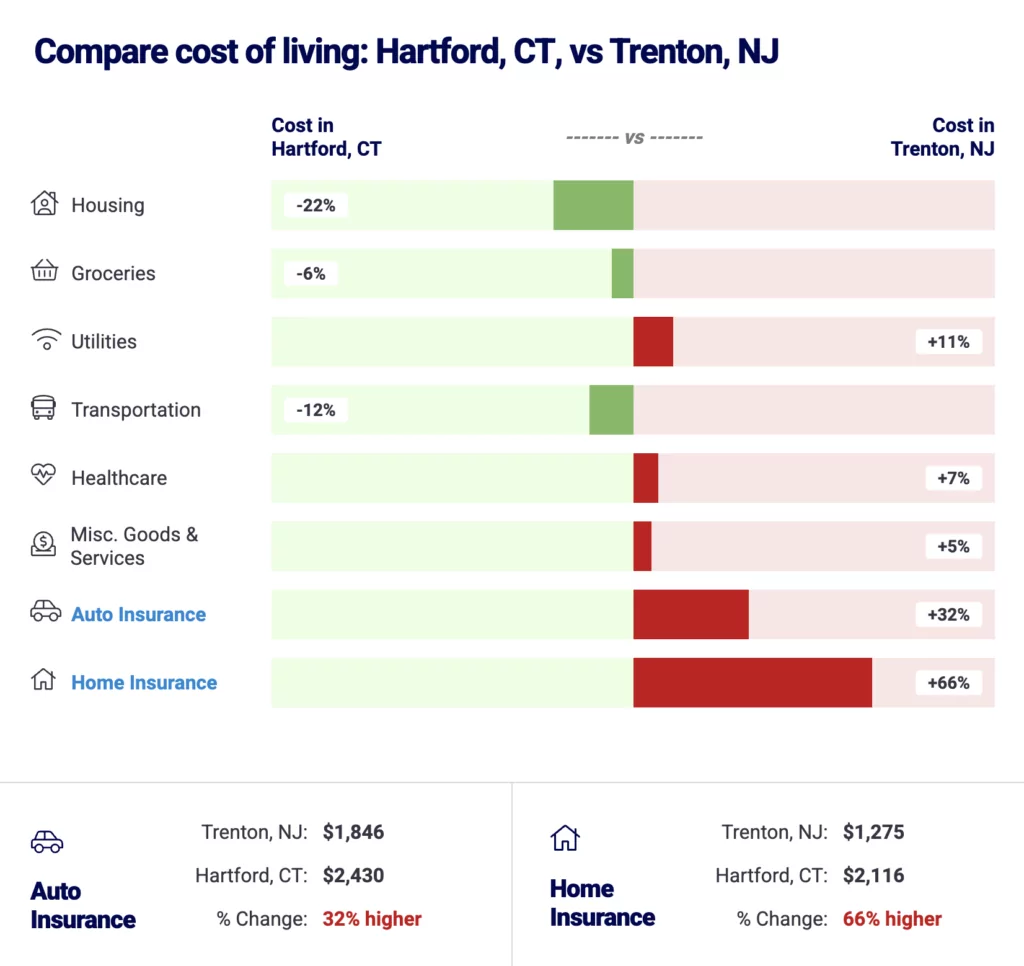

To illustrate these variances, let’s consider a hypothetical comparison of living costs assuming that the author of the post is choosing between the capital cities of New Jersey and Connecticut:

A Reddit user pointed out the stark differences in living expenses across states, saying,

“80k might seem substantial, but it might only offer a modest lifestyle in certain parts of Connecticut, while $40k in New Jersey might not go far.”

Another user emphasized the importance of taking into account additional factors like rent, utilities, and other living expenses when evaluating a job offer.

In conclusion, while the numeric value of a salary is essential, its real worth is deeply intertwined with the geographic and economic context of the job’s location. Before making a decision, it’s vital to evaluate how far that salary will truly stretch in terms of quality of life and financial security.

Financial Management and Lifestyle Choices

Financial literacy and astute management are often the unsung heroes behind a comfortable lifestyle, even more so than a hefty paycheck. The way an individual manages, saves, invests, and spends their earnings can deeply influence their overall well-being and future financial stability.

The Illusion of Affluence: A substantial paycheck can sometimes create an illusion of endless affluence, leading individuals to adopt lavish lifestyles, make impulsive purchases, or neglect savings. This is especially true for those who experience a sudden spike in their earnings. But as expenses rise to meet income, they can find themselves in a precarious financial position, even with a high salary.

Budgeting and Savings: The cornerstone of financial well-being is a well-thought-out budget. By allocating funds for necessities, savings, investments, and leisure, individuals can strike a balance that ensures both present-day contentment and future security. It’s not uncommon for someone with a modest income but rigorous budgeting habits to achieve significant financial milestones, like buying a home or retiring early.

Investment Choices: Beyond just saving, making informed investment choices can amplify one’s wealth. Whether it’s investing in stocks, bonds, real estate, or even self-improvement courses, the right choices can yield significant long-term returns.

Lifestyle Choices: While it’s essential to enjoy one’s earnings, discerning between ‘wants’ and ‘needs’ can make a vast difference. For instance, choosing a modest car over a luxury brand or occasionally dining out rather than frequently indulging can lead to substantial savings over time.

Reflecting on these insights, a Reddit user pointed out,

“Some people who make 80k live paycheck to paycheck just like some people making 40k don’t.”

The fact that a high salary is not a guaranteed ticket to financial security; it’s one’s financial habits that truly count. Another user emphasized the importance of evaluating lifestyle choices, potential savings, and financial aspirations when considering a job offer, suggesting that one’s approach to money management can be as influential, if not more so, than the paycheck itself.

While a competitive salary is undoubtedly an enticing factor in job decisions, it’s merely a single component of a broader financial picture. By understanding the long-term implications of salary, accounting for regional living expenses, honing negotiation skills, and adopting sound financial practices, recent graduates can craft a holistic career path that aligns seamlessly with both their professional aspirations and life goals.

The Bottom Line

Returning to the heart of the discussion—the pressing question posed on Reddit, “Would you rather take an $80K job or a $40K job?”—it’s clear that the answer isn’t as straightforward as choosing a higher number. The deliberation unearths layers of considerations, from understanding the potential of a starting salary to the nuances of geographical living expenses, the art of negotiation, and the crucial role of financial management.

While the allure of a bigger paycheck is undeniable, the broader spectrum of factors determines its true worth. Whether a recent graduate or a seasoned professional, one’s career decisions should be rooted in both immediate benefits and long-term aspirations, considering personal values, lifestyle choices, and financial goals.

Ultimately, the best choice aligns with an individual’s holistic life vision, ensuring not just financial comfort but also professional satisfaction and personal fulfillment. The Reddit community has spoken, providing a myriad of perspectives and insights. Still, the final decision rests in the hands of the individual, armed with knowledge and clarity of purpose.

Follow us on Reddit for more insights and updates.

Comments (0)

Welcome to A*Help comments!

We’re all about debate and discussion at A*Help.

We value the diverse opinions of users, so you may find points of view that you don’t agree with. And that’s cool. However, there are certain things we’re not OK with: attempts to manipulate our data in any way, for example, or the posting of discriminative, offensive, hateful, or disparaging material.