Compound interest plays a pivotal role in the world of finance, and it comes in various forms. One of the most intriguing forms is continuous compounding. In this article, we will delve into the continuous compounding formula, its derivation, examples, and frequently asked questions.

✅ AI Essay Writer ✅ AI Detector ✅ Plagchecker ✅ Paraphraser

✅ Summarizer ✅ Citation Generator

What Is Continuous Compounding Formula?

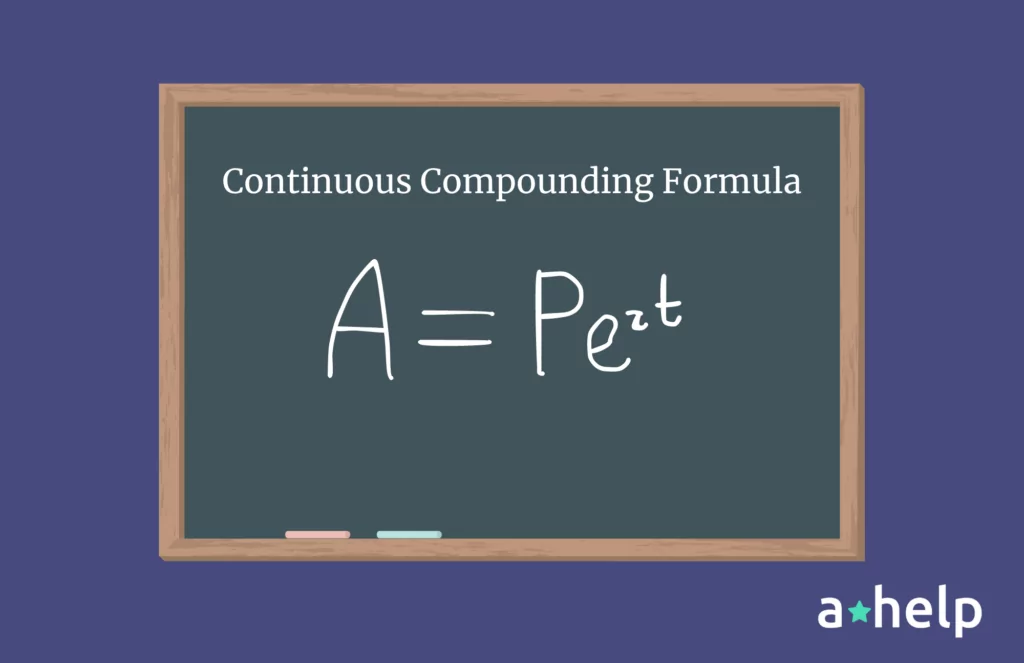

Continuous compounding is a concept used in financial calculations when interest is compounded infinitely. The formula that governs this unique calculation is the continuous compounding formula, which is expressed as:

In this formula:

- A represents the final amount.

- P denotes the initial amount or principal.

- r signifies the rate of interest.

- t represents the time.

- e is a mathematical constant approximately equal to 2.7183.

This formula is particularly useful when the problem statement explicitly mentions that the amount is compounded continuously.

Deriving the Continuous Compounding Formula

To understand how the continuous compounding formula is derived, let’s start with the standard compound interest formula:

A = P(1 + r/n)^(nt)

In this formula, n is the number of times the initial amount (P) is compounded in the time t, and A is the final amount or future value. For continuous compound interest, n approaches infinity. We can take the limit of the above formula as n approaches infinity:

A = lim (P(1 + r/n)^(nt)) as n → ∞

Using one of the limit formulas, which states that lim (1 + r/n)^n = e^r, we arrive at the continuous compound interest formula:

A = Pert

This derivation showcases the relationship between continuous and discrete compounding, highlighting how continuous compounding becomes relevant when the compounding frequency tends towards infinity.

Applying the Continuous Compounding Formula

Example 1: Calculating Future Value

Let’s consider an example to demonstrate the application of the continuous compounding formula. Tina invested $3000 in a bank that pays an annual interest rate of 7%, compounded continuously. We want to find out the amount she can get after 5 years.

- Initial amount (P) = $3000

- Interest rate (r) = 7% or 0.07

- Time (t) = 5 years

Using the continuous compounding formula:

A = Pert

A = 3000 × e^(0.07 × 5) ≈ 4257

Therefore, Tina can expect to have approximately $4,257 after 5 years.

Example 2: Determining the Interest Rate

In another scenario, we might need to find the rate of interest for a given amount to double over a specific period with continuous compounding. Let’s take an example:

Suppose you have $5,300, and you want it to double in 8 years with continuous compounding. We need to find the rate of interest (r).

- Initial amount (P) = $5,300

- Final amount (A) = $10,600 (double of $5,300)

- Time (t) = 8 years

Using the continuous compound interest formula:

A = Pert

10600 = 5300 × e^(8r)

After some calculations:

r = (ln 2) / 8 ≈ 0.087

So, the required rate of interest is approximately 8.7%.

Example 3: Long-Term Investment

Jim decides to invest $5000 in a bank that pays an annual interest rate of 9%, compounded continuously. He plans to keep his money invested for 15 years and wants to know the amount he can expect to have at the end of this period.

- Initial amount (P) = $5000

- Interest rate (r) = 9% or 0.09

- Time (t) = 15 years

Using the continuous compounding formula:

A = Pert

A = 5000 × e^(0.09 × 15) ≈ 19287

Jim can anticipate having approximately $19,287 after 15 years.

In conclusion, understanding the continuous compounding formula is essential for anyone involved in financial calculations. This formula provides a powerful tool for handling scenarios where interest is compounded continuously, and it can be applied to a wide range of real-world situations, as demonstrated in the examples provided above. Whether you’re calculating future values, interest rates, or long-term investments, the continuous compounding formula is a valuable asset in your financial toolkit.

FAQ

Follow us on Reddit for more insights and updates.

Comments (0)

Welcome to A*Help comments!

We’re all about debate and discussion at A*Help.

We value the diverse opinions of users, so you may find points of view that you don’t agree with. And that’s cool. However, there are certain things we’re not OK with: attempts to manipulate our data in any way, for example, or the posting of discriminative, offensive, hateful, or disparaging material.