According to a recent analysis by Yahoo Finance, investors are keenly eyeing Advanced Micro Devices (AMD), backed by Wall Street’s bullish views. This report delves into whether investing in AMD is a prudent decision, considering the optimistic brokerage recommendations and how they influence stock prices.

✅ AI Essay Writer ✅ AI Detector ✅ Plagchecker ✅ Paraphraser

✅ Summarizer ✅ Citation Generator

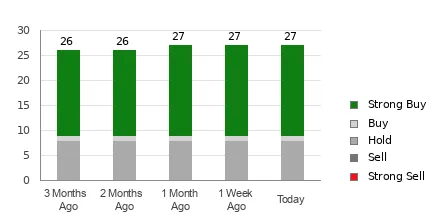

Advanced Micro Devices currently holds an impressive average brokerage recommendation (ABR) of 1.35, indicating a strong inclination towards buying. This rating is based on the assessments of 30 brokerage firms, with 24 recommending a “Strong Buy” and one advocating for a “Buy.” Such a high ABR suggests a positive market sentiment towards AMD.

However, the article cautions against making investment decisions based solely on brokerage recommendations. Studies have revealed that these recommendations often have limited success in guiding investors to stocks with the best price increase potential. This discrepancy arises from the vested interests of brokerage firms, which often result in a positive bias in their analysts’ ratings.

“Our research shows that for every ‘Strong Sell’ recommendation, brokerage firms assign five ‘Strong Buy’ recommendations.”

Yahoo Finance specifically highlights the potential conflict of interest that may not align with retail investors’ goals. In contrast, the Zacks Rank, a proprietary stock rating tool, is suggested as a more reliable indicator. Unlike the ABR, which is calculated based on brokerage recommendations, the Zacks Rank is driven by earnings estimate revisions and has a track record of accurately predicting near-term stock price movements.

“The ABR is calculated solely based on brokerage recommendations… In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions.”

This difference is crucial, as the Zacks Rank quickly reflects changes in a company’s business trends, offering timely insights into potential price movements.

As for AMD, the Zacks Consensus Estimate for the current year has seen an increase of 0.4% over the past month, signaling growing optimism about the company’s earnings prospects. This optimism is backed by a Zacks Rank #2 (Buy) for Advanced Micro, suggesting that the company’s stock might be a wise investment in the near term.

Discuss Investment Opportunities in an Essay

Diving into the story of AMD’s stock and Wall Street’s optimistic views opens up a whole world of exciting topics for finance students like you. It’s not just about whether AMD is a good investment; it’s about understanding how the whole stock market game works.

Why do analysts say what they say? How do their words affect a stock like AMD? And what other tools can we use to make smart investment choices? These essay topics will take you from the specifics of AMD’s situation to the bigger picture of how stocks move and shake based on what the experts say. It’s perfect for anyone who’s into finance and wants to get a deeper understanding of how to navigate this complex world. Let’s jump into these topics and see what secrets the world of finance has to reveal!

| Focus Area | Essay Topics |

|---|---|

| Direct Focus on AMD | 1. Analyzing AMD’s Stock Performance: A Wall Street Perspective |

| 2. The Role of Brokerage Recommendations in AMD’s Stock Valuation | |

| 3. Advanced Micro Devices (AMD): A Case Study in Investment Analysis | |

| 4. The Impact of Earnings Estimate Revisions on AMD’s Stock Performance | |

| Broader Investment Themes | 1. The Influence of Analyst Ratings on Stock Market Movements |

| 2. Understanding the Effectiveness of Quantitative Models in Stock Predictions | |

| 3. Brokerage Firms’ Recommendations: Bias and Impact on Investors | |

| 4. A Comparative Study of Different Stock Rating Systems | |

| 5. The Role of Earnings Estimates in Shaping Market Expectations |

Follow us on Reddit for more insights and updates.

Comments (0)

Welcome to A*Help comments!

We’re all about debate and discussion at A*Help.

We value the diverse opinions of users, so you may find points of view that you don’t agree with. And that’s cool. However, there are certain things we’re not OK with: attempts to manipulate our data in any way, for example, or the posting of discriminative, offensive, hateful, or disparaging material.