In the escalating landscape of higher education costs, an increasing number of parents find themselves grappling with financial unpreparedness to shoulder their children’s college expenses. According to a recent study, parental apprehension over insufficient funds to cover tuition fees is reaching new heights, with escalating inflation and rising costs adding to the strain.

✅ AI Essay Writer ✅ AI Detector ✅ Plagchecker ✅ Paraphraser

✅ Summarizer ✅ Citation Generator

Key Takeaways:

- Increasing college expenses are causing financial anxiety among parents, with more feeling unprepared to bear these costs.

- Alternative funding sources are gaining popularity among parents.

- Early and informed financial planning is critical to navigate the high cost of higher education.

Escalating College Costs and Parental Anxiety

The escalating cost of higher education is causing monetary stress among families, with many feeling less prepared to meet these expenditures than in previous years. The study from Discover Student Loans reveals that about 70% of parents are anxious about having enough funds for their children’s college education, a marked rise from 66% the previous year and 63% in 2021.

“College tuition and fees have grown twice as fast as the Consumer Price Index (CPI) over the last two decades”

The financial burden continues to escalate, with college expenses, particularly tuition inflation, drastically outpacing the average cost of living. According to Best Colleges, average annual tuition inflation was 5.1% at public colleges and 3.9% at private colleges between 2000 and 2020.

Parents cite several reasons for their financial unease. For nearly half of the respondents, inflation and rising costs straining savings and spending were a primary concern.

“Families should aim to have conversations early and often about college costs and job and salary prospects after graduation”

Rise of Scholarships and Loans

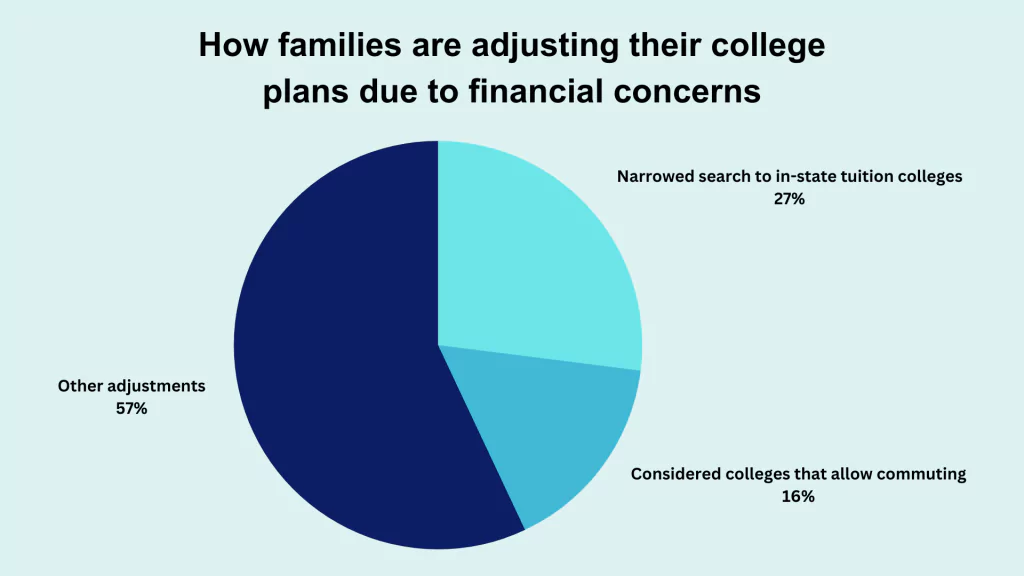

In response to the soaring higher education costs, families are finding themselves needing to adjust their college plans. Financial concerns have begun dictating important decisions about their children’s academic paths. The Discover survey sheds light on these changes, revealing that 27% of families have had their children narrow their college search to institutions with in-state tuition rates, which are typically lower than out-of-state fees. Meanwhile, 16% of families have had to consider colleges that allow commuting from home to eliminate the additional costs associated with room and board on campus.

Scholarships and grants, traditionally viewed as supplementary sources of college funding, have become more critical. A notable shift in reliance on these aids is evident, with a rise from 54% in 2021 to 61% in 2023, indicating a seven-point increase. Scholarships and grants have the advantage of not requiring repayment, hence lessening the future financial burden on students and their families.

However, as scholarships and grants are often competitive and may not cover all college expenses, many families are turning to student loans as a vital component of their funding strategy. The survey reports an upward trend in this area as well, with nearly 45% of parents planning to utilize student loans, reflecting a four-point surge from 2022 and a considerable 18-point leap from 2021. The loans considered include a combination of federal and private student loans, with 55% of parents opting for both types, while 42% plan to use federal student loans exclusively.

Despite these adaptations and strategic moves, the reliance on loans underlines the extent of the financial strain families are facing. It emphasizes the reality that even as families exhaust scholarships and savings options, many still find a significant gap in college funding that must be filled with borrowed money, leading to potential long-term financial implications. This reliance on borrowing highlights the urgent need for practical solutions and policy interventions to address the burgeoning crisis of college affordability.

Options for Financing Higher Education

In this climate of escalating tuition rates and economic inflation, families are exploring various options to finance their children’s higher education. Some of these strategies include 529 college savings plans or Roth IRAs.

Over $411 billion has been saved in more than 16 million open 529 accounts as of December 2022. These plans allow investors to withdraw funds tax-free for nearly any college expense. The caveat, however, is a potential 10% tax penalty if funds are used for non-education expenses.

Roth IRAs, primarily retirement accounts, can also serve as a college savings vehicle.

“Money in a Roth IRA grows tax-free, and you can withdraw funds before retirement without paying an early withdrawal penalty if the money is used to cover education costs”

Refinancing private student loans to a better interest rate is another potential strategy to lower monthly payments and ease the financial burden.

| Financial Challenge | Response | Details |

|---|---|---|

| Rising cost of higher education | Adjusting college plans | 27% limiting searches to in-state tuition colleges; 16% considering colleges allowing commuting from home |

| Insufficient scholarships and savings | Increasing reliance on student loans | 45% of parents plan to use student loans; 55% considering both federal and private loans; 42% planning on federal loans only |

| Need for long-term savings plan | Utilizing 529 college savings plans | Over $411 billion saved in over 16 million open 529 accounts |

| Requirement for flexibility in savings | Utilizing Roth IRAs | Funds grow tax-free, can be withdrawn for education costs without early withdrawal penalty |

| High interest rates on existing loans | Refinancing private student loans | Potential strategy to lower monthly payments and ease financial burden |

The rising cost of higher education presents a significant financial challenge to many families, and it’s causing a shift in how parents plan for their children’s college expenses. From limiting college searches to local institutions to increasing reliance on scholarships and student loans, parents are exploring all available avenues. Moreover, parents are turning to alternative funding sources such as 529 college savings plans and Roth IRAs. The importance of financial preparation and informed decision-making in navigating this costly endeavor has never been more crucial.

Also read:

What Is Save for College NYC Program?

Fresh Grads Encounter Challenges in Salary Negotiations

College Application Essays Are Becoming A New Venue to Discuss Race

Follow us on Reddit for more insights and updates.

Comments (0)

Welcome to A*Help comments!

We’re all about debate and discussion at A*Help.

We value the diverse opinions of users, so you may find points of view that you don’t agree with. And that’s cool. However, there are certain things we’re not OK with: attempts to manipulate our data in any way, for example, or the posting of discriminative, offensive, hateful, or disparaging material.